Online sales keep growing fast. Businesses sell across borders and reach more shoppers than ever before. Yet, this surge in digital buying brings new dangers: cunning criminals use every gap they find. When so many transactions happen around the clock, small security flaws can cause big losses. Fortunately, AI in fraud detection helps retailers stay a step ahead.

Below, we’ll explore how advanced systems and learning techniques boost security. We’ll cover how each customer can pay with peace of mind, how to spot risky orders, and how to guard your store’s financial health. We’ll explain the algorithms and patterns that help businesses stop scams before they happen. Along the way, we’ll highlight the machine-driven strategy and models that keep you safe. We’ll also touch on ethical concerns, detecting anomalies, and building a resilient technology process. We’ll provide information in a relevant way so you can protect your customers through the proper integration of AI tools.

The rising threat of e-commerce fraud

Fraudsters chase money. As more stores move online, more criminals look for cracks. Today’s digital climate demands a deeper defense than outdated filters. Below, we’ll see why e-commerce fraud has spiked and how criminals grow bolder.

The expansion of online retail increases the potential for cyberattacks

The world of online retail is expanding at record speed. Many stores struggle to protect their systems as they reach new markets. Statista shows that revenue in e-commerce was over $5 trillion in 2022. The risk of fraud grows together with a business.

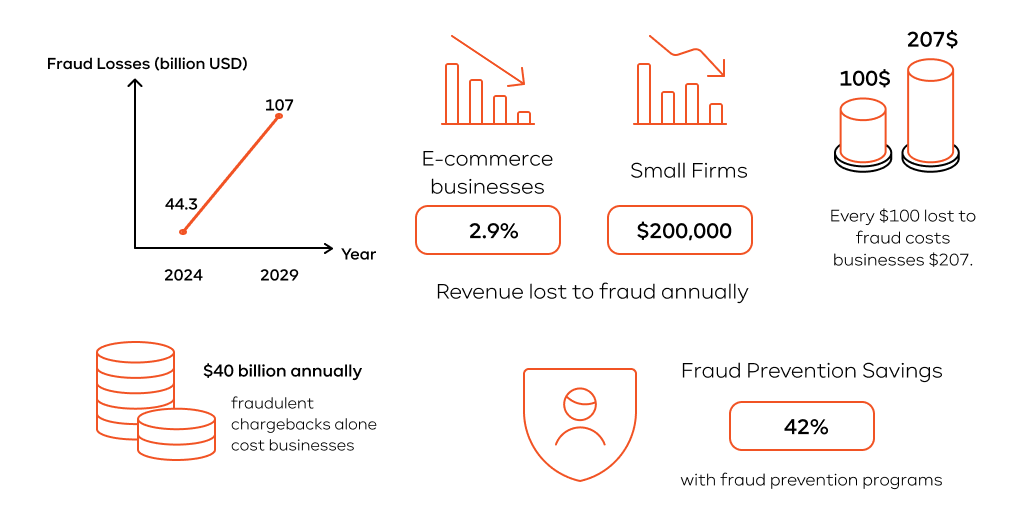

Juniper Research predicted that worldwide online retail fraud would top $48 billion in 2023. Many merchants launch global services but fail to track each payment type, currency, or region. Fraudsters spot these gaps and exploit them. They use card-testing bots or stolen credentials to jump from site to site, looking for loose oversight.

In truth, some teams focus on marketing growth and neglect robust defense. They may only check basic card details or rely on blocklists for known bad IPs. Yet, criminals change their methods. If a store can’t adapt, it’s an easy target. One slip can cause hefty losses and major stress for honest shoppers.

Sophisticated fraud patterns

Today’s fraud isn’t just about stolen credit cards. Criminals use synthetic identity fraud, mixing real and fake data to make new profiles. They hide behind triangulation fraud, where a fake seller takes payments, then buys from your store with stolen details. Promo abuse is also common: attackers game promo codes or referral links to get free items or deep discounts.

AI fraud detection is crucial because old rules often fail against these tactics. Fraud rings automate tasks and merges with normal buyer behavior. By the time a store sees the problem, it’s too late. That’s why real-time analysis and advanced detection are game-changers.

Financial and reputational costs of fraud

High fraud leads to direct financial losses. Chargebacks alone cost merchants big sums in fees and stolen items. They can pay triple the cost of the goods when they account for penalties, labor, and overhead. At the same time, brand image suffers if fraud runs rampant.

A report from CyberSource confirm that a breach dents consumer trust. Shoppers may leave if they see suspicious activities or if their cards get declined for no good reason. It’s hard to repair this damage once it’s public. Earnings can drop while legal issues or negative press swirl.

AI’s role in turning the tide

Artificial intelligence fraud detection helps you reclaim control. Traditional methods rely on rigid rules. Attackers learn those rules and slip through the cracks. AI scans vast data points at lightning speed. It looks at buyer activity in milliseconds and flags suspicious orders.

Faster detection

AI in fraud prevention can process many events per second. It reviews each purchase for unusual elements like device changes, repeated order attempts, or big jumps in spending. That speed allows your system to halt scams before they cause harm.

Real-time prevention

A well-tuned solution of AI in fraud detection does more than just observe. It can freeze shady transactions on the spot. When an attacker tries to exploit a stolen card, the system can block it mid-checkout if the risk score is too high.

Adaptive defense

AI learns from new fraud strategies. When criminals switch methods, an AI solution updates its risk scoring. Over time, it builds a deeper sense of what’s normal and what isn’t. This “living” engine means you’re not stuck with old data or static rules. AI in fraud detection is a reliable protection against ever-evolving threats.

The limitations of traditional fraud prevention

Legacy solutions try, but they have faults that criminals exploit. To see why AI in fraud prevention matters, we should note where older setups fall behind.

Rule-based systems

Rule-based technology sets lines in the sand. For example, any order above a certain dollar amount gets flagged, or all orders from certain countries get blocked. Criminals adapt fast. They split large orders into smaller ones or switch IP addresses. Once they see your pattern, they change theirs. Soon, your rules fail.

High false positives and customer friction

Simplistic filters can harm good customers. If someone travels abroad and uses a foreign IP, an old system might flag them. If they change a delivery address, that might also raise alarms. Buyers faced with extra steps or order rejections might leave. That friction can kill sales.

Each flagged order also adds costs. You must investigate or manually review suspicious cases. If the system is too sensitive, you lose real revenue and annoy loyal shoppers.

Manual review bottlenecks

Staff can review orders for possible fraud. They check addresses, phone numbers, or email domains. That’s fine in small doses. But on peak days, thousands of orders flood in. Human teams can’t scale that much. By the time they finish reviews, criminals may have already moved on to another site.

Lack of adaptability to evolving fraud tactics

Hackers and scammers evolve. They build new scripts and try fresh angles. A static system won’t spot these changes unless you rewrite the code or rules. This rewiring takes time and money. During the gap, more fraud seeps through. You end up one step behind.

_______________________________________________________________________

Learn about another popular use case of AI in e-commerce:

AI-Driven Chatbots: Transforming Customer Service in Online Retail

_______________________________________________________________________

How AI is changing the game

Fraud detection AI goes beyond checklists. It combines vast data with real-time analysis to catch criminals off guard. The difference lies in how AI learns buyer habits.

Behavior-based analysis instead of static rules

AI-based algorithms measure normal user flows. They note session duration, typical cart sizes, shipping addresses, and more. They then compare each new order to that baseline. If they see a big shift or suspicious pattern, they dig deeper. This dynamic approach outperforms rigid thresholds.

Real-time anomaly detection and pattern recognition

Many criminals mask their location or create multiple profiles. They often test stolen cards with a number of small orders. AI can see these patterns in real time. It might notice repeated failed attempts or IP mismatches. Then it tags these orders for further checks or blocks them.

Adaptive learning – models improve as they ingest more data

Machine learning techniques help your system stay ahead. Supervised learning trains on labeled past fraud cases, while unsupervised learning uncovers hidden problems that no one has labeled. When your AI sees new data, it adjusts. That means each wave of bad activity makes your defense stronger.

Multi-signal fusion: combining device, location, behavior, and transaction data

A modern artificial intelligence for fraud detection engine pulls data from many sources:

- Device fingerprints (browser info, operating system)

- IP geolocation

- Past buying history

- Email domain reputation

- Behavioral clues (time on site, items viewed)

By blending these signals, the system produces accurate risk scores. False positives drop because the AI gains context about each buyer.

Common AI-powered fraud use cases in e-commerce

AI isn’t limited to one kind of scam. It helps retailers tackle many fraud threats at once. Here are some common trouble areas.

Account takeover detection

Hackers can steal login details from data leaks or phishing. Once inside a user’s profile, they might change the password or order items quickly. AI notices these changes right away, like strange login times or new devices. It flags such events so you can step in and confirm the user’s identity.

Payment fraud

Attackers use stolen credit cards or guess card numbers by brute force. Fraud prevention AI looks for mismatched billing addresses, odd order values, or repeated attempts in a short time. When suspicious signs pile up, the system auto-blocks or requests more verification.

Promo abuse

Scammers exploit promotional coupons by creating many accounts, often with a VPN. They might redeem the same coupon code many times. An artificial intelligence for fraud recognition system can detect this pattern of repeated signups or repeated discount usage. It helps you keep discounts valid for honest buyers only.

Fake accounts & bots

Criminals make fake profiles to post reviews, launder money, or test card numbers. AI in fraud detection can spot these mass signups, which often come from the same device or follow a robotic routine. The system ends them before they make purchases or cause trouble.

AWS services that power AI-based fraud prevention

For many modern retailers, AWS offers a solid base for artificial intelligence for fraud recognition. Its range of services covers every part of the pipeline, from data ingestion to final alerts.

Amazon Fraud Detector

Built for e-commerce, this service uses pre-trained models. It examines your data—IP addresses, payment info, device signals—and returns a risk score. This AI fraud prevention engine also integrates with other AWS tools to automate real-time decisions.

Amazon SageMaker

Need custom solutions? SageMaker lets you build, train, and deploy your own machine learning models. You can add special data points or unique signals if your store has unusual risks. SageMaker’s pipeline manages model updates, so your detection keeps evolving.

Amazon Kinesis / Lambda

Real-time detection needs fast data streams. Amazon Kinesis ingests order events, while Lambda functions process those events. If the system detects an order with high risk, Lambda can block it, inform a manager, or ask for more authentication. This approach scales during peak sales without slowing your site.

AWS Glue / Athena

To train effective models, you need historical information. AWS Glue extracts and cleans data, then loads it into data stores. Athena runs SQL queries on that data lake for quick insights. Together, they help you refine your approach to fraud detection using AI. You can spot trends, label problem orders, and test new rules.

Amazon CloudWatch / GuardDuty / WAF

CloudWatch collects logs from across your systems. GuardDuty inspects those logs for threats, while AWS WAF filters harmful traffic. Each service helps maintain strong security. You can also feed these logs back into your artificial intelligence fraud detection pipeline, improving its knowledge of bad actors.

_______________________________________________________________________

See how this can work for your online store!

Contact IT-Magic for a consultation on AI in fraud detection. Our team will assess your current environment and recommend a strategy tailored to your goals.

_______________________________________________________________________

Our approach at IT-Magic: architecting for secure, intelligent fraud defense

We design setups that merge AWS services with AI in fraud detection. Our goal is to give you strong, real-time protection without slowing your store. Let’s outline our method.

Infrastructure blueprint

We focus on AI in fraud prevention using AWS serverless. Your checkout page sends data to Amazon Kinesis. A Lambda function then calls Amazon Fraud Detector to get a risk score. If the score is high, the function logs the event and can halt the sale. DynamoDB stores order details for later analysis.

Below is an example layout:

| Component | Function |

| Kinesis Data Stream | Takes orders as they arrive in real time. |

| Lambda Function | Receives data from Kinesis, contacts Fraud Detector. |

| Amazon Fraud Detector | Delivers AI-based risk scores. |

| DynamoDB | Keeps transaction histories for reviews or audits. |

| CloudWatch | Gathers logs and triggers alerts on suspicious activities. |

Red-flag escalation

When a shady transaction appears, CloudWatch triggers a notification. Your team may get an immediate alert on Slack or email. If the risk is high, the system can freeze the account or add extra verification steps. This quick response prevents fraud losses while letting normal orders sail through.

IAM and encryption best practices

We ensure compliance with standards such as PCI DSS by using IAM roles, secure keys through AWS KMS, and encryption in DynamoDB. We also encrypt data in transit with HTTPS. Every action is logged to provide an audit trail if an issue arises. This thorough approach keeps your store safe.

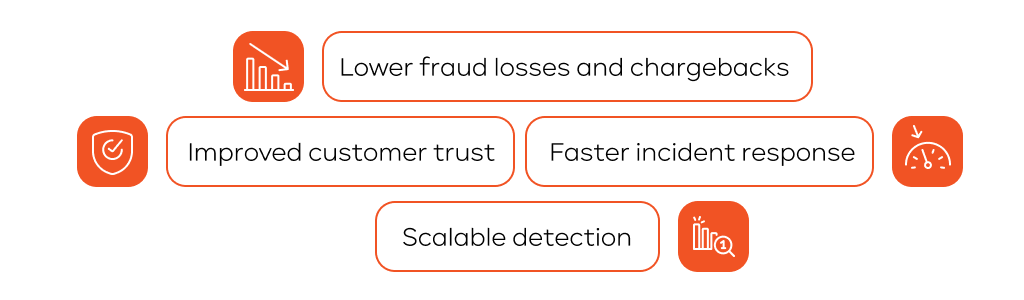

Business outcomes from AI fraud detection

AI isn’t just a fancy tool. It delivers real value and peace of mind. Here’s how:

Lower fraud losses and chargebacks

A robust AI in fraud detection system identifies and stops bad orders early. That means fewer chargebacks and disputes. Some businesses see a 60% drop in fraud costs once they switch to artificial intelligence for fraud detection. If your margins are tight, that’s a huge saving.

Improved customer trust

Accurate fraud prevention AI means fewer false declines. Real shoppers don’t get blocked when they make harmless changes to their profiles. That leads to smoother checkouts, happier buyers, and better reviews. Loyal customers appreciate a store that keeps their data safe.

Faster incident response

An AI and fraud detection setup logs risky events in real time. Your security team only investigates the top alerts. They don’t waste time combing through thousands of low-risk transactions. This boost in efficiency means you’re ready to stop big attacks before damage spreads.

Scalable detection

During holiday sales or promotions, the number of transaction increses. With older methods, you’d add staff or accept higher fraud. AI scales automatically. It deploys extra computing power as needed. That lets you capture new sales without leaving your store unprotected.

Challenges and considerations

AI in fraud detection isn’t foolproof. You need to plan, gather data, and follow the rules of privacy. Here are some things to keep in mind.

Cold start

A brand-new store has limited historical data to train on. As a result, your AI engine might struggle at first. One fix is synthetic data, which simulates real orders without exposing personal info. Another fix is to use pre-trained models that you tweak over time. Once you gather enough real sales, the AI gets smarter.

Balancing sensitivity and UX

If you make the system too strict, you’ll reject genuine shoppers. A looser setup, however, could let more fraud through. Finding a sweet spot involves testing, reviewing false positives, and monitoring user feedback. Over time, you can fine-tune thresholds to reduce risk and keep paying clients happy.

Compliance for data handling

When dealing with buyer data, you must respect privacy laws like GDPR. That means anonymizing personal information, controlling who sees the data, and using it only for legitimate reasons. Meanwhile, PCI DSS calls for the safe storage and processing of payment information. AWS provides a platform to follow these rules, but you must set it up correctly.

Cost of real-time inference

Real-time AI checks can be pricey if you handle huge volumes of orders. AWS helps with cost-saving features like auto-scaling groups and spot instances. In some cases, batch scoring is possible for lower-priority checks. Always consider the balance between top-level security and your computing budget.

Metrics to track and improve

Success means more than just blocking fraud. It means fine-tuning your system so real customers stay happy. Track these metrics to measure progress:

Fraud detection accuracy

Focus on precision and recall. Precision is how many flagged transactions are actually bad, while recall is how many fraud attempts you catch out of all that occur. Balancing both helps you catch threats without blocking too many good orders.

False positive/negative rate

The false positive rate measures how many valid purchases you wrongly block. Too many false positives can drive users away. The false negative rate counts how many fraudulent orders slip through. Both need attention to keep your store profitable and safe.

Chargeback rate over time

This is a clear sign of how well your system works. If your chargeback rate falls after adding AI fraud detection, you know it’s paying off. A stable or rising chargeback rate means you need to adjust thresholds or gather more training data.

Model drift detection and retraining frequency

Fraud tactics evolve. If your model’s accuracy drops, that might be model drift. Plan to retrain with new data. AWS helps by letting you schedule retraining jobs, so your system stays fresh against emerging threats.

Time to resolution for flagged transactions

Even the best AI systems may flag certain orders for human review. How fast does your team resolve these tickets? A shorter resolution time improves customer experience. It also lets staff catch big scams before they grow.

Final thoughts: AI as a strategic weapon against fraud

Criminals don’t stand still. They keep coming up with new tricks. Classic tools can’t keep pace with these complex attacks. By contrast, AI in fraud detection monitors and adapts as soon as it sees a new tactic.

Traditional tools aren’t enough

In 2025, e-commerce scams are more aggressive than ever. Simple thresholds fail under advanced attacks. We’re seeing mass identity theft, code exploitation, and multi-stage fraud. Traditional setups can’t pivot in real time to handle these risks.

AI + AWS gives retailers an edge

An AWS-based approach combines learning with steady security. You get real-time anomaly checks, rapid decisions, and minimal overhead. You can block shady orders, adapt to new threats, and keep your loyal buyers happy. It’s the best way to stay one step ahead of criminals without draining your budget.

By combining AI in fraud detection with modern AWS tools, you can safeguard your revenue, brand image, and customer trust. The future of e-commerce demands real-time, adaptive defenses. Don’t let criminals slip by – take action now with AI fraud prevention and protect your store for years to come.

Reach out to our cloud security team to assess your current fraud defenses and explore AI-based solutions

We’ll protect your business in a fast-changing online world. Get a reliable AI solution merged with AWS services for a robust and scalable framework that fully suits your business requirements.

FAQ

Can AI help reduce false positives and improve the customer experience?

Yes. Artificial intelligence fraud detection looks at behavior rather than simple rules. It’s more flexible, so it won’t block as many good orders. This leads to smoother checkouts, happier buyers, and fewer headaches for your staff.

What happens if fraud tactics evolve – will the AI model keep up?

Absolutely. AI models learn from new fraud attempts. They retrain with fresh data, so you don’t rely on last month’s info. As scammers shift their techniques, your system evolves.

How long does it take to implement an AI-powered fraud prevention system?

Timelines vary, but using AWS tools speeds up deployments of AI in fraud detection. Some stores go live in a few weeks. You can start simple and improve over time, rather than wait for a giant in-house project.

Can AI-based fraud prevention integrate with my existing e-commerce platform?

Yes. Fraud detection using AI works with Shopify, Magento, custom-built sites, and more. AWS services connect through APIs or plug-ins. With the right planning, you can insert an AI-based solution into your current flow, no complete rebuild required.